How GA Hard Money Lenders Can Help You Secure Fast Financing for Your Projects

How GA Hard Money Lenders Can Help You Secure Fast Financing for Your Projects

Blog Article

Everything You Must Learn About Hard Cash Lenders and Their Benefits

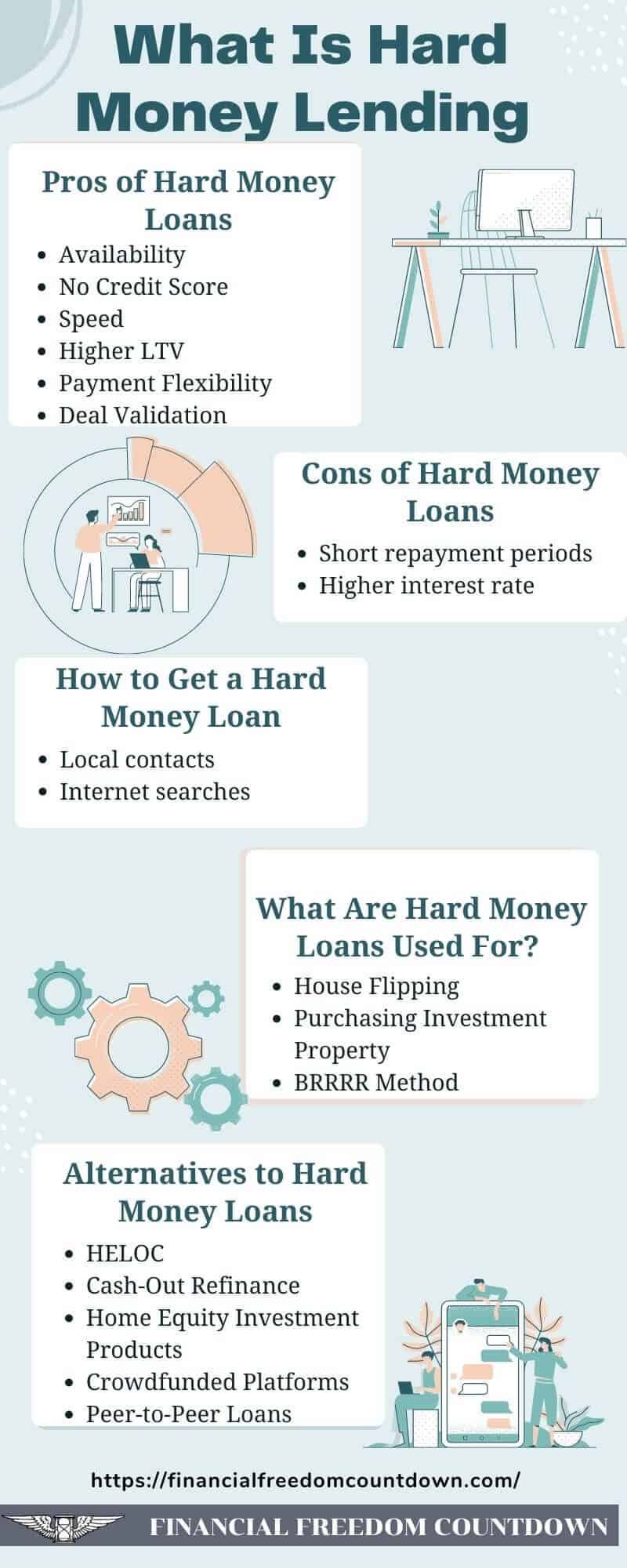

Tough money lending institutions represent a special funding choice, specifically for actual estate transactions where standard lending may drop brief. While the advantages of tough cash lendings are remarkable, including versatility and expedited processes, it is crucial to navigate the connected risks thoughtfully.

What Are Tough Cash Lenders?

While conventional funding alternatives typically entail lengthy approval processes and stringent credit demands, difficult cash loan providers offer a more flexible option for borrowers seeking quick access to resources. Difficult cash lenders are exclusive people or firms that supply temporary lendings protected by property possessions. Unlike standard financial institutions that count greatly on the consumer's credit reliability and income, hard cash lending institutions concentrate largely on the worth of the security being supplied.

These loans are generally used genuine estate deals, including residential property purchases, improvements, or financial investment possibilities. The approval process for hard cash loans is normally expedited, frequently causing financing within days instead of weeks. ga hard money lenders. This rate is particularly helpful for investors seeking to maximize time-sensitive opportunities in the property market

Rate of interest on hard money loans are normally greater than typical finances due to the enhanced risk entailed, yet they serve an important objective for customers that might not certify for standard financing. Eventually, tough money lenders play a critical role in the property financial investment landscape, offering necessary funding options that enable consumers to seize chances promptly and efficiently.

Just How Tough Money Lending Works

Tough money lendings are usually short-term financings protected by genuine home, mostly utilized for investment purposes. Unlike traditional car loans that depend heavily on creditworthiness and income verification, difficult money loan providers concentrate on the worth of the collateral residential property.

The procedure begins when a debtor approaches a hard money lending institution with a certain real estate project, offering details regarding the residential or commercial property and the meant use funds. The lending institution reviews the residential or commercial property's value and problem, commonly performing an evaluation. Based on this analysis, the loan provider establishes the finance amount, typically ranging from 60% to 75% of the property's after-repair worth (ARV)

As soon as terms are set, consisting of rates of interest and repayment routines, the car loan is shut, and funds are disbursed. Debtors are generally anticipated to repay the lending in one to three years, making difficult cash lending an appropriate option for those needing quick accessibility to funding for financial investments or urgent building acquisitions.

Secret Advantages of Hard Money Fundings

Hard money finances stand out for their ability to provide fast accessibility to funding, making them an appealing option genuine estate investors and programmers. Among the main advantages of difficult money finances is the rate of financing, often shutting within days as opposed to weeks. This quick turnaround can be critical in affordable actual estate markets, permitting consumers to seize opportunities quickly.

Additionally, tough money car loans are based mostly on the worth of the security, typically real estate, rather than the debtor's creditworthiness. This allows people with less-than-perfect credit report histories to protect financing. The flexibility in underwriting standards likewise enables for personalized finance frameworks that can satisfy certain project requirements.

One more considerable advantage is the potential for bigger financing quantities - ga hard money lenders. Difficult money lenders frequently provide greater loan-to-value ratios, making it possible for financiers to fund significant jobs without requiring extensive capital gets. Additionally, tough cash car loans can be used for a range of purposes, consisting of residential property flips, restorations, or obtaining troubled properties, making them flexible devices in a financier's funding technique.

Considerations and dangers

Although tough money car loans offer many benefits, they also include inherent dangers and factors to consider that possible consumers need to thoroughly examine. One of the main threats is the higher interest rates linked with these finances, which can significantly enhance the total expense of loaning. Consumers might find themselves in a perilous economic scenario if they fall short go to this web-site to pay back the funding within the specified timeframe, as tough money lenders usually enforce stringent payment due dates.

One more factor to consider is the potential for foreclosure. Provided that tough money financings are secured by property, failure to meet settlement commitments can cause the loss of the residential or commercial property. Furthermore, difficult money lenders might not offer the same degree of regulative oversight as standard economic establishments, which can cause aggressive borrowing practices.

In addition, while difficult money lendings can offer quick accessibility to funding, consumers must guarantee they have a well-thought-out exit strategy to prevent prolonged dependence on high-interest financial obligation. The absence of complete underwriting procedures can lead to over-leveraging, making it important for consumers to examine their economic security and task feasibility prior to continuing with a tough money finance.

Selecting the Right Hard Cash Lending Institution

Choosing the best difficult money lender is an essential step in browsing the borrowing process, especially after taking into consideration the inherent threats associated with these loans. To make sure an effective borrowing experience, it is important to evaluate potential lending institutions based on their track record, experience, and regards to solution.

Begin by looking into lenders in your location. Search for endorsements and reviews, which can offer insight right into their reliability and expertise. Respectable lending institutions must have a clear application procedure and clear interaction.

Following, analyze the loan provider's experience in the certain kind of property you are funding, whether household, commercial, or commercial. A skilled lending institution will certainly recognize the regional market dynamics and potential threats related to your task.

Finally, make certain that you feel comfy with the loan provider and their group. Building a good relationship can promote smoother communication throughout the funding procedure, ultimately bring about effective project completion. By taking these steps, you can pick a difficult cash loan provider that meets your demands efficiently.

Verdict

In summary, difficult money lenders provide a additional reading different financing service that focuses on genuine estate value over debtor credit reliability. Careful option of a dependable hard cash lender further enhances the possibility of a successful loaning experience.

Report this page